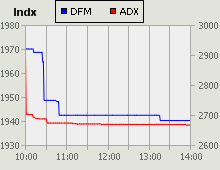

UAE market news & discussions for 30 November 2009As many investors feared, the UAE markets tanked horrendously when they reopened after the Eid break, after statements last week that were interpreted as indicating a debt default was a possibility for Nakheel and Dubai World. On Friday, WAM, the official UAE news agency, reported that the bloodbath was apparently expected when they said that "The Government is spearheading the restructuring of this commercial operation in the full knowledge of how the markets would react." The same news release also said that "Further information will be made available early next week." Obviously, whatever that information was, it wasn't enough to reassure UAE investors when the stock markets opened today. Dubai Financial MarketThe Dubai Financial Market (DFM) fell 7.3% to 1940 points from just 37m worth of trading, a tiny amount, but unsurprising given that every traded stock bar one, closed 5% or 10% limit down with no buyers queuing up. The lone stock with buyer interest at close was Dubai National Insurance & Reinsurance (DNIR). Abu Dhabi Securities ExchangeAbu Dhabi plunged by 8.3% to 2668 points from 117m worth of trades. Emirates Telecom (ETISALAT) and National Bank of Abu Dhabi (NBAD) were included in the list of limit down stocks, even though National Bank of Abu Dhabi (NBAD) was one of the few banks to actually take the opportunity to show that there is more than just talk of investor relations in the UAE - they released figures to show the extent of their loan exposure to Dubai World. Given that they won a recent award for investor relations, it would have been embarrassing if they hadn't. Two other banks released statements - CBI said they had no exposure, and FGB said their exposure wasn't what the media said it was but didn't tell us what it was anyway. The only gainer was Abu Dhabi National Building Materials (BILDCO), up just 1% from a single trade. The least bad loser was Ras Al Khaimah White Cement (RAKWCT), down 5.15% to 0.92. |

|

UAE stock market news and discussions at Dubai Share Talk ...

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Comment on this report and view previous reports on the Share Wadi blog.

- Discuss UAE companies at Dubai Share Talk.