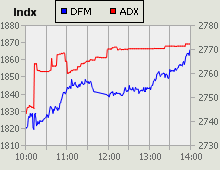

UAE market news & discussions for 03 January 2010Both UAE markets were in the green with solid gains on high volumes in Dubai, led by Emaar and Arabtec. On the Nasdaq Dubai at 1415 UAE time, DP World is down 4.2% and Depa is down 9.8%. Dubai Financial MarketThe Dubai Financial Market (DFM) rose 3.4% to 1866 points from turnover of AED 908m with over half of that from Emaar Properties (EMAAR), up 7.8% to 4.16 from AED 508m worth, and the best of the more active gainers. Arabtec (ARTC) was the only other stock trading more than AED 100m worth, up 6.3% to 2.85 from AED 184m. HITS Telecom was the top gainer, up 11.2% but from just two trades. Deyaar Development (DEYAAR) rose 6.9% to 0.62, Dubai Financial Market (DFM) was up 4.8%, Islamic Arab Insurance (IAIC) 4.6%, Dubai Islamic Insurance (AMAN) 4.1%, Al Madina Finance (ALMADINA) 4.0%, and most other stocks were up less than 4%. There were only three losers, Gulf General Investment (GGICO) the worst, closing 5% limit down at 1.05 from low volumes, and Gulf Finance House (GFH) the only loser trading more than AED 1m worth, down 0.93%. Abu Dhabi Securities ExchangeThe ADX rose 1.05% to 2772 points from turnover of AED 135m with Aldar Properties (ALDAR), up 1.2% to 5.06 from AED 45m of turnover, and Sorouh Real Estate (SOROUH), up 4.2% to 2.75 from AED 36m, the only two stocks trading more than AED 10m worth. Top gainer was National Corporation for Tourism & Hotels (NCTH) closing 10% limit up at 9.20 but from just two trade. Sorouh was the best of the more active gainers, Ras Al Khaimah Properties (RAKPROP) rose 3.45%, Arkan Building Materials (ARKAN) 3.4%, Abu Dhabi Commercial Bank (ADCB) 3.2%, and the remaining gainers were up less than 3% or on low volumes. Al Buhaira National Insurance (ABNIC) was the worst loser, 10% limit down at 9.27 from greater than usual volumes. Finance House (FH) fell 1.7%, Waha Capital (OILC) was down 1.1%, and the other losers fell on low turnover. Emirates Telecom (ETISALAT) rose 2.3% to 11.20, and National Bank of Abu Dhabi (NBAD) was unchanged at 12.40. |

|

UAE stock market news and discussions at Dubai Share Talk ...

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Comment on this report and view previous reports on the Share Wadi blog.

- Discuss UAE companies at Dubai Share Talk.