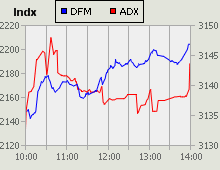

UAE market news & discussions for 23 September 2009It was a green welcome back from the Eid holiday on the UAE markets. The ADX rose 1.4% to 3144 points from turnover of AED 463m. The DFM rose a decent 3.6% to 2204 points from substantial volumes of AED 1.6 billion with heavy trading in DFM shares, Emaar, Arabtec, Dubai Investments, and Union Properties, with DFM and DIC rising more than 10%. The Nasdaq Dubai was closed and will reopen tomorrow. Dubai Financial MarketDubai Financial Market (DFM) shares were the most actively traded with AED 289m worth of deals, and a 10.9% rise to 2.45 putting it at the top of the gainers list also, except for a couple of small trades in Arab Insurance Group (ARIG) and Global Investment House (GLOBAL). Emaar Properties (EMAAR), up 1.7%, saw turnover of AED 242m, Arabtec (ARTC) rose a solid 8.5% from AED 225m worth of deals, and volumes were also over AED 100m for Dubai Investment Company (DIC) (+10.1% to 1.42) and Union Properties (UPP) (+7.2% to 1.04). Dubai Islamic Insurance (AMAN) was also amongst the leading stocks with a rise of 9.85%, and Islamic Arab Insurance (IAIC) was up 7.1%. Shuaa Capital (SHUAA) rose 5.6%, Al Salam Bank Sudan (ALSALAMSUDAN) 5.2%, and the remaining stocks were up less than 5%. There were no losers. Abu Dhabi Securities ExchangeSorouh Real Estate (SOROUH) was the most active stock in Abu Dhabi and the only one trading more than AED 100m with a 4.7% rise to 4.04 from AED 127m worth of shares traded. First Gulf Bank (FGB) was the best of the more active gainers, rising 4.9% to 17.45, Waha Capital (OILC) was up 3.4%, Aldar Properties (ALDAR) 3.2%, and the remaining gainers were up less than 2% or on low volumes. There were 6 losers, only 2 of them with more than AED 1m worth of trading, Abu Dhabi Islamic Bank (ADIB) down 1.5%, and Abu Dhabi Commercial Bank (ADCB) down 2.3% on greater than usual volumes. |

|

UAE stock market news and discussions at Dubai Share Talk ...

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Comment on this report and view previous reports on the Share Wadi blog.

- Discuss UAE companies at Dubai Share Talk.